Ankr Flash Unstake arrives to Ethereum: Unlock LSTs liquidity in just 1 transaction

Tiago Pratas

December 20, 2023

4 min read

Despite staking being one of the most used DeFi strategies, the process of unstaking, can become a cumbersome activity with lengthy locking periods. Tackling this inefficiency, Ankr released a flash unstake feature for BNB liquid-staked tokens back in February and is now expanding it to Ethereum, updating both unstaking mechanics.

TL;DR:

- Unstaking periods are a cumbersome feature of the most popular DeFi strategy.

- Flash unstake enables users to have instant liquidity for their LSTs, thus optimizing their capital efficiency.

- After successfully introducing the feature to ankrBNB, Ankr is now expanding its offering to Ethereum LST users’.

- Ankr flash unstake v2 will introduce dynamic fees, which may enable lower fees.

Unstaking Constraints

Leveraged on the widespread implementation of proof-of-staking networks, staking has become a leading DeFi strategy, enabling users to compound rewards on their tokens. On the back of it, liquid staking - enables users to stake tokens, and in exchange mint a wrapped token that encompasses the underlying asset and the staking rewards - is a strategy that has captured a lot of users’ attention, allowing them to stay liquid while earning rewards from their stake.

However, regardless of the staking strategy the user opts for, when they try to unstake, they have to face a lock period that can go up to 30 days. This is highly inefficient, since the tokens are not accruing any additional yield, and can’t be used on any different DeFi endeavor.

These lock periods are in place to prevent malicious activities toward the network, thus maintaining network security and promoting a healthier staking environment. Nevertheless, they also encompass a huge opportunity cost for the final user.

Flash Unstake: onboarding Ethereum, the largest DeFi blockchain

Understanding the constraint and the inefficiency that the unbounding periods present for the users, earlier this year, Ankr introduced a Flash Unstaking feature for the ankrBNB LST. We are now happy to announce that upon the success we’ve seen on that feature, we are expanding it to ETH and ankrETH. Implementing this new feature for ankrETH will significantly reduce the unstaking time for users, with the unstaked ETH being sent on the same transaction.

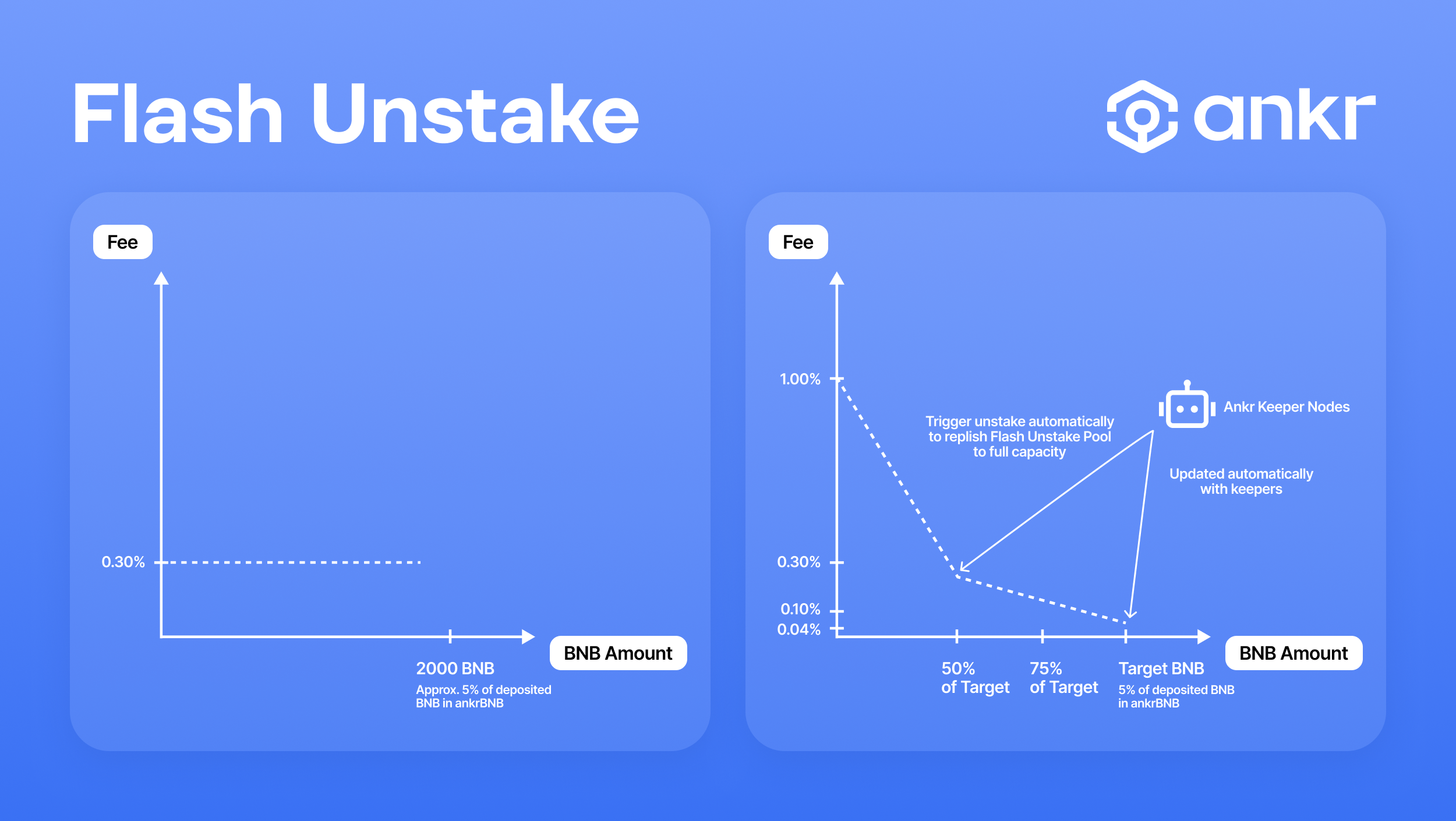

But changes don’t end here. When Ankr first released the flash unstaking feature for the ankrBNB token, a fixed technical service fee of 0.5% was proposed. However, with the release of the ankrETH Flash Unstaking feature, these fees will change from a fixed to a dynamic structure.

The new framework, to be implemented for both BNB and ETH solutions, will base fees on the tokens' balance, creating a more responsive solution for its users. Thus, the fee will be adjustable depending on the amount of available ETH/BNB. As the availability increases, the fee decreases, and vice versa.

This structure aims to maintain the pool's health and competitiveness, offering an advantage over typical DEX swap fees and slippage. Furthermore, by introducing a dynamic fee, Ankr will be able to, under certain conditions, lower the previously proposed fixed fee.

To ensure Flash Unstake sustainability, Ankr's strategy involves in reserving 5% of the total staked tokens in their original form. Therefore, whenever a user tries to Flash Unstake, they withdraw from that 5% pool.

The updated version reveals that only half of that value (2.5% of the total staked tokens) is needed to maintain the current fee structure. Consequently, this implies that every time the reserve approaches 50% of the intended target, users will benefit from a lower service fee.

Framework of Ankr Flash Unstake - v1 vs v2.

Framework of Ankr Flash Unstake - v1 vs v2.

Flash Unstaking: Improving LSTs liquidity

Ankr’s flash unstaking feature significantly enhances the liquidity of ETH LSTs and eliminates one of the largest staking barriers. This is only possible since Ankr provides liquid staking services that enable the immediate exchange between tokens.

Furthermore, one may think that by having an LST token, it would already be able to use it on any other DeFi endeavor. Even though LSTs open many doors in terms of capital efficiency, this ain’t completely true. LSTs, being tokens created by third parties, don't offer the same utility as the original asset, since they can't be used for certain functions like paying gas fees, and not every platform accepts them.

By facilitating the exchange of LSTs for the original asset in a seamless manner, flash unstaking ensures that users can instantly receive the original asset back in their wallets, unlocking the full potential of the held tokens and reducing the necessity of deep liquidity on Liquidity Pools.

This immediate conversion process is a key advantage, distinguishing it from traditional staking mechanisms that typically involve lengthy lock periods. On top of this, depending on the token balance, at the swap time, transactions may be cheaper and with less slippage than swapping on a DEX.

Furthermore, flash unstaking empowers users with unparalleled flexibility in their DeFi activities. Since this process allows for instant staking and unstaking, users can swiftly shift their strategies and capital in response to the evolving DeFi landscape.

In such a fast-paced ecosystem, agility can make the difference between being early or late to new opportunities. The ability to quickly adapt and move assets around leads to more effective capital management and potential leveraging of new opportunities.