Staking infrastructure.Liquid, secure, and easy to integrate.

Liquid Staking solutions for all shapes and sizes.

Total Value Locked

$0

Total Stakers

0

Liquid Staking Opportunities

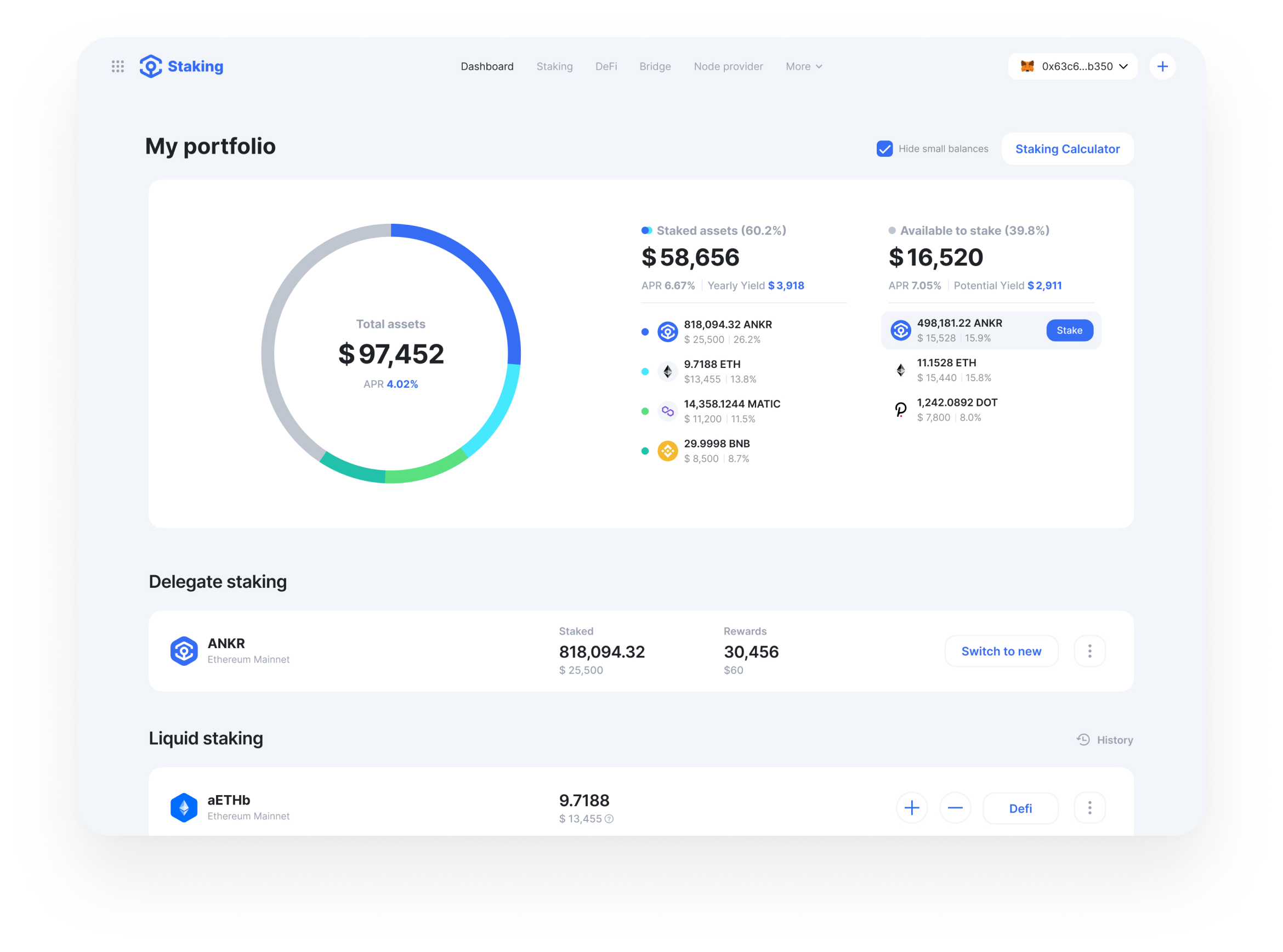

Ankr offers liquid, secure, and easy to integrate staking infrastructure to enterprise customers through our network of Enterprise Staking Partners.

Liquid Staking for Integrators

Integrate Liquid Staking and become an entry point to the DeFi 2.0

Easy integration, frictionless access, agile infrastructure, and safeness.

Integration DocsLiquid Staking for Staker

User-friendly, profitable, transparent, and secure Liquid Staking

Launch App1. Stake your crypto and get liquid staking tokens

2. Use liquid staking in DeFi to boost your yield

3. Keep getting staking rewards

What’s the idea of Liquid staking?

Unlike regular staking, Ankr issues you Liquid staking tokens. They are equivalent to the staked assets plus the accumulated staking rewards. They can be used almost the same way as original assets, and thats why it’s called Liquid staking.

Reward-bearing liquid staking token

Rewards are built in. Grows in value to the staked asset daily to represent staking rewards.

For example, now 1 ankrETH = ETH

Cross-chain

staking experience

Ankr Bridge enables you to bridge liquid staking tokens to different blockchains for maximum earning opportunities and a cross-chain staking experience.

Launch Ankr BridgeStake from any chain • Enjoy more liquidity • Find more trading opportunities • Stake from any chain • Enjoy more liquidity • Find more trading

Boost your yields with Ankr DeFi

Let liquid staking tokens work for you with boundless DeFi opportunities.

Provide liquidity and earn trading fees

Lock your LP tokens and get additional farming rewards

Lend or borrow against your staked tokens

Deposit liquid staking tokens in a vault to compound yields