Ankr and Midas Partner to Launch Innovative Liquidity Pool

May 2, 2023

5 min read

The Ankr Liquid Staking Solution

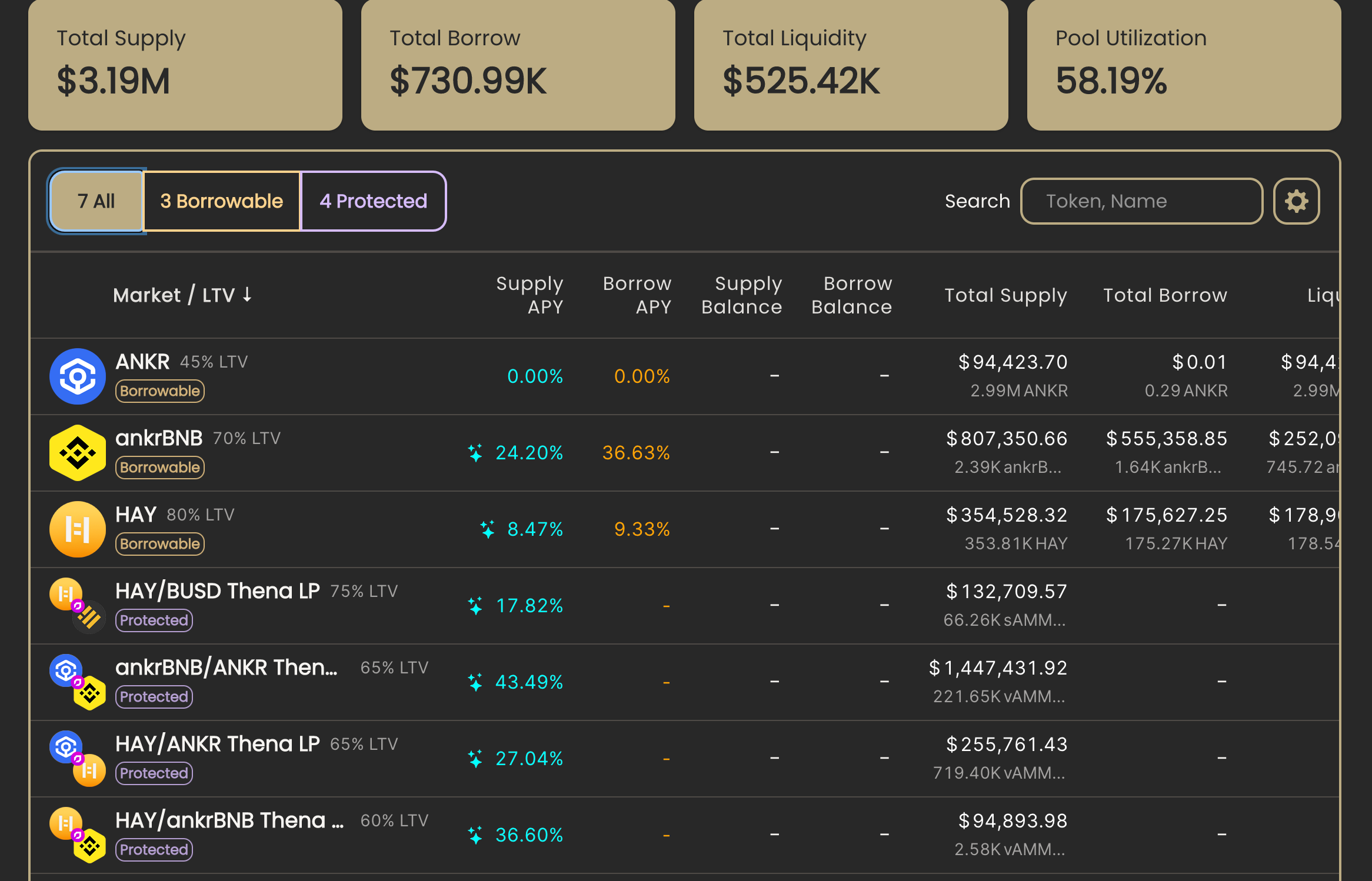

The partnership between Ankr and Midas has resulted in the creation of an innovative liquidity pool that addresses one of the key limitations of traditional staking. With the Ankr Liquid Staking solution, users can earn rewards while maintaining their asset liquidity. However, the latest addition of the isolated lending and borrowing pool for AnkrBNB with the additon of HAY, and Thena LPs opportunities takes this to the next level.

Unlocking Isolated Lending Pools

The isolated pool solution offered by Midas in a partnership with Ankr is a custom interest rate model that guarantees a minimum yield for lending LPs higher than other pools. This makes it more rational for users to provide liquidity for such pools without the need for unreasonable incentives. It enables users to lend and borrow assets in a single pool, which is a major innovation in the DeFi space.

The pool not only has AnkrBNB but also HAY and Thena LPs. This allows users to deposit and borrow against different assets, providing them with greater flexibility and capital efficiency. Midas automatically stakes the LP position on Thena, enabling users to acquire THE rewards while being able to borrow against their LP position.

The Efficiency of Ankr and Midas' Solution

Moreover, by leveraging the yield generated from Thena LPs, users can borrow the assets that compose the LP and deploy them on Thena again, compounding their earnings and maximizing their returns. This provides users with a powerful tool for managing their cryptocurrency assets and earning passive income through staking and liquidity provision.

The Ankr and Midas partnership is a game-changer in the DeFi space. It provides a flexible and efficient way to participate in staking activities while maintaining liquidity. The isolated pool solution ensures that users have access to a minimum yield for lending LPs, which is higher than other pools, ensuring they get the best returns on their investments.

One of the key advantages of this innovative solution is that it allows users to participate in staking activities without sacrificing liquidity. This is essential in a rapidly evolving market like DeFi, where the value of different assets can change rapidly. With this liquidity pool, users can keep their assets liquid while earning rewards, which is a unique proposition in the DeFi space.

Another key advantage of the Ankr and Midas partnership is the efficiency of their solution. The new IRM implemented eliminates the need for unreasonable incentives to attract liquidity, as users have access to a minimum yield higher than other pools. This ensures that liquidity providers get the best returns on their investments, with minimal effort and time.

Ankr’s Growing Focus on the Binance Smart Chain

Ankr has been focusing on the Binance Smart Chain and has partnered with to increase the TVL of ankrBNB. By doing so, they have achieved the highest TVL on BSC. Ankr also has a massive BNB pool with innovations that get at capital efficiency.

Ankr has been focusing on growing the total value locked (TVL) and utilization of ankrBNB on the Binance Smart Chain (BSC). Currently, Ankr has the highest TVL of liquid staked BNB on the BSC network due to our consistent work in the ecosystem. Furthermore, Ankr has released ankrETH on the Binance network as well.

In addition, Ankr has developed a massive BNB pool with innovations that increase capital efficiency. By focusing on the BSC network, Ankr is able to offer innovative capabilities to the DeFi space, making it an attractive option for those looking to participate in the non-custodial crypto ecosystem.

Participate in the Liquidity Pool

If you are interested in participating in the Ankr Liquid Staking solution with the isolated lending and borrowing pool, you can check it out on Midas Capital Pool here.

This innovative solution is set to change the game for DeFi liquidity provision. By using a separate lending and borrowing pool, Ankr Liquid Staking provides users with greater flexibility in terms of staking and lending their assets. This means that users can earn rewards both from staking and lending their assets, which in turn leads to greater capital efficiency

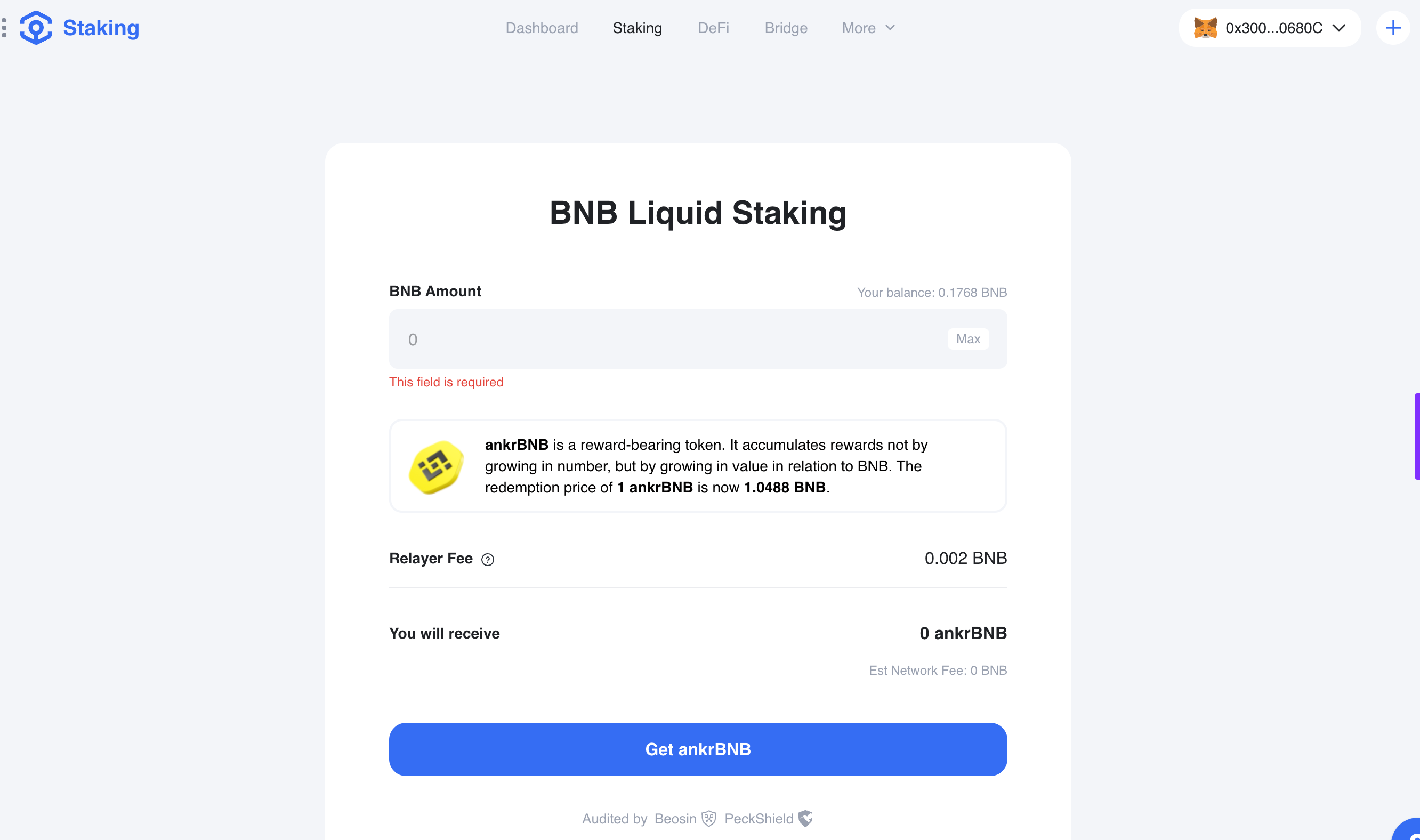

How to Acquire ankrBNB for Liquidity Pool

To acquire ankrBNB, users can go to Ankr's staking dashboard and stake their BNB. This will allow them to earn rewards in the form of ankrBNB, which can then be used to participate in the innovative liquidity pool created by Ankr and Midas. Alternatively, users can trade for ankrBNB on secondary exchanges (see full list of DEXs with ankrBNB).

Staking BNB on Ankr's staking dashboard is a straightforward process that can be completed in just a few steps. Once a user has staked their BNB, they will begin earning rewards in the form of ankrBNB, which can be used to participate in the liquidity pool. Trading for ankrBNB on secondary exchanges like DEXs is another option for users who do not have BNB to stake. However, it is important to note that trading on DEXs can be riskier than staking on Ankr's dashboard, so users should exercise caution and do their research before making any trades.

Deposit ankrBNB in the Midas Pool

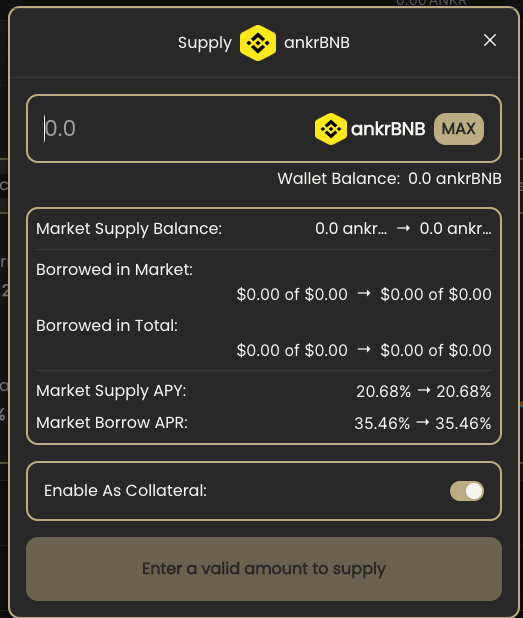

To get started all you’ll need to do is deposit your newly acquired ankrBNB into the Midas pool. You will do this by first navigating to the Midas Pool, and then clicking on the row that says ankrBNB.

From there you will click supply.

Which will prompt you to deposit the amount of ankrBNB that feels suitable for you. As of writing this, the APY is a whopping 23.76% for supplying ankrBNB. So not only will you get the staking yield from having BNB liquid staked, you’ll also receive a double digit yield on top of that.

Conclusion

In conclusion, the Ankr and Midas partnership and the launch of the innovative liquidity pool with isolated lending and borrowing is a significant development in the DeFi space. It addresses the limitations of traditional staking by providing a flexible and efficient way to participate in staking activities while maintaining liquidity. The addition of the isolated pool solution ensures that users have access to a minimum yield higher than other pools, which makes it more rational to provide liquidity. With greater flexibility and capital efficiency, this innovative solution is set to change the game for DeFi liquidity provision.