Ankr Unlocks the Power of Omnichain Liquid Staking

Ethan Nelson

May 22, 2023

4 min read

Through solutions like bridging and liquidity pools on various chains, ankrETH is going truly omnichain.

In this article, we will explore Ankr's flagship product, ankrETH, on the Ethereum network, and delve into the exciting prospects of ankrETH on other chains, such as BNB, FTM, AVAX, Polygon zkEVM, and Arbitrum. Furthermore, we will discuss the next steps for Ankr, highlighting the token utility and the advantages of flash unstaking and liquid liquid staking narratives.

Expansion of Omni-chain Solutions

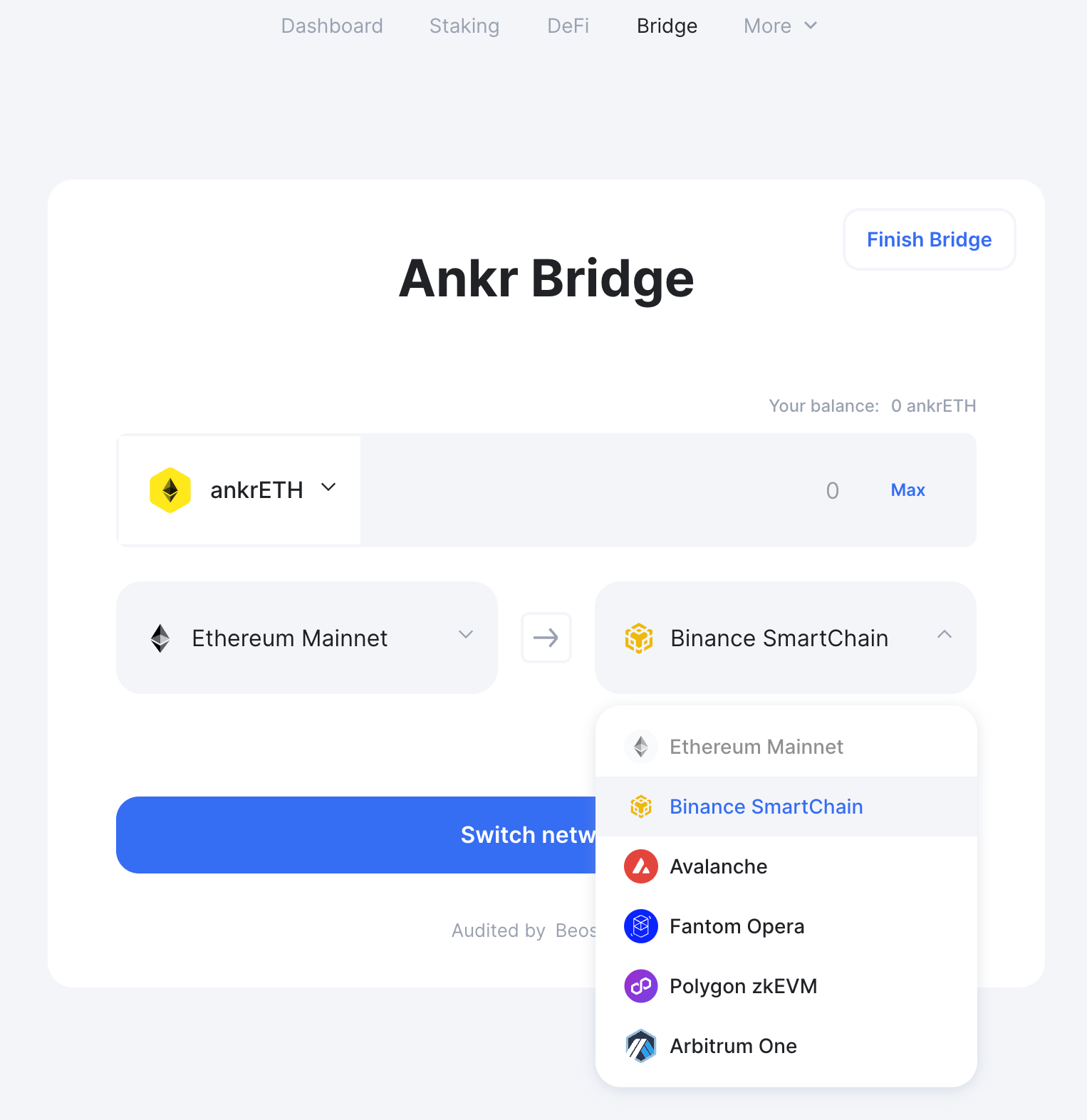

Ankr's vision extends beyond Ethereum, as we bring the benefits of ankrETH liquid staking to multiple chains. By expanding our offering to chains such as Binance Smart Chain (BNB), Fantom (FTM), Avalanche (AVAX), Polygon zkEVM, and Arbitrum, we open up a world of opportunities for stakers. Each chain presents unique advantages and LP opportunities, with the potential for enticing APYs.

When users liquid stake their ETH with Ankr they receive ankETH on the Ethereum mainnet. Then, users can bridge their ankETH to others chains using the bridge feature on Ankr’s staking web app.

Or, you can also exchange your tokens on various chains for ankrETH on various DEXs. This not only unlocks users to reap the staking rewards of Ethereum staking on other chains but also allows greater interoperability of Ethereum with other chains. Ankr’s omni-chain solution is truly leading edge in the DeFi space.

Empowering Ethereum Holders with ankrETH

Ankr's Ethereum liquid staking solution, initially introduced as aETHb/c and now known as ankrETH, holds the distinction of being the first to market in the realm of liquid staked Ethereum. Ankr's innovative approach revolutionized the staking landscape by offering users the ability to stake their Ethereum while simultaneously unlocking liquidity through the issuance of ankrETH tokens. This groundbreaking concept garnered significant attention within the DeFi community, propelling Ankr to the forefront of liquid staking offerings.

One of the key factors that sets Ankr apart is its impressive annual percentage yield (APY). Ankr not only provides users with the opportunity to stake their Ethereum and earn staking rewards but also ensures that they receive one of the highest APYs among all liquid staked Ethereum offerings in the market. This attractive APY incentivizes users to participate in Ankr's liquid staking ecosystem, as they can maximize their earnings while still having access to the liquidity of their staked assets.

Furthermore, Ankr solidified its position as an industry leader by being the first solution to unlock unstaking after the Shanghai upgrade. This upgrade, implemented on the Ethereum network, introduced important protocol changes and improvements. Ankr swiftly adapted to these changes, enabling users to easily unstake their Ethereum and convert their ankrETH back into Ethereum when needed. This flexibility and responsiveness further establish Ankr as a trailblazer, setting the standard for liquid staked Ethereum and providing users with enhanced control over their staked assets.

Liquid Staked Ethereum Omni-Chain Yield Farming

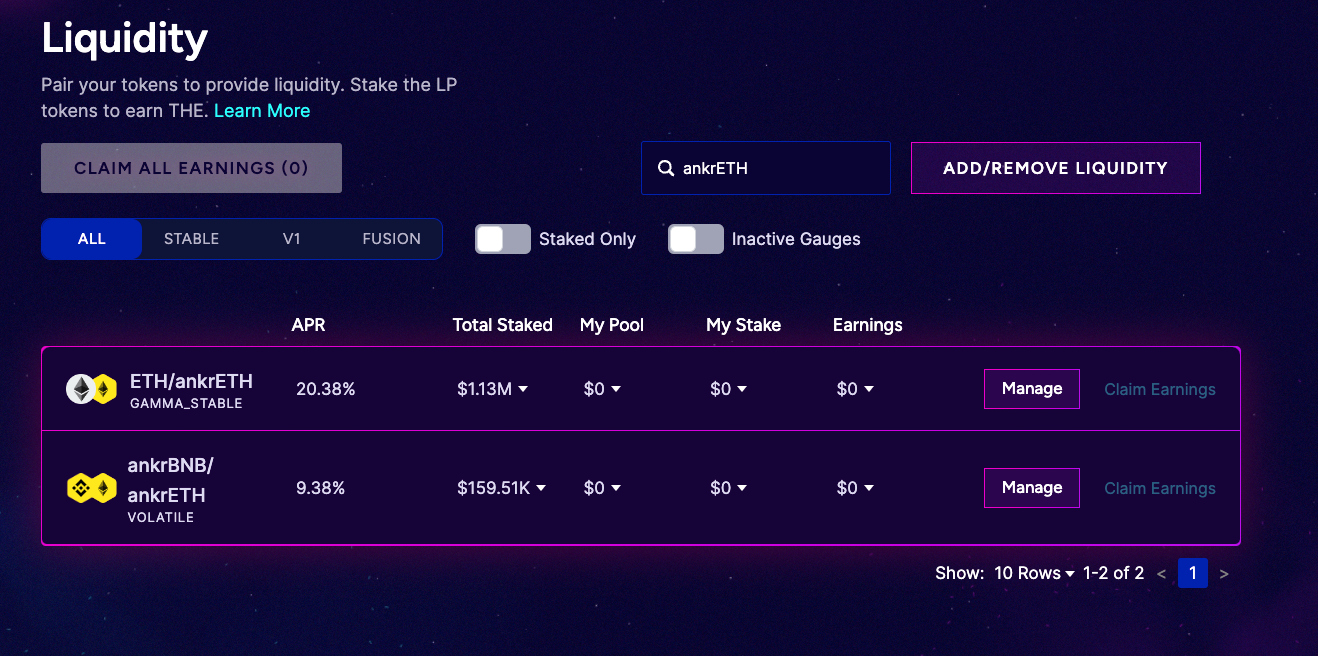

You can claim competitive APY with ankrETH on chains like the Binance Smart Chain (see the Thena Pool).

With an APY of ~20% and the staking yield added on top of that from ankrETH you can earn industry-leading yield by adding your ankrETH to liquidity pools on DEXs.

Thena provides two ankrETH options. One pair includes ankrBNB with the ankrETH and the other pool includes ETH with the ankrETH. You can either swap for ankrETH or you can provide liquidity to the pool and earn yield.

If you’re looking for other competitive yield farming strategies with other Ankr liquid staking tokens we’re recommend checking out the Beethoven X ankrFTM pool and Midas capital ankrBNB pool.

Improving Token Utility and Capital Efficiency

Ankr's commitment to token utility is a driving force behind our innovative approach to liquid staking. The utility of ankrETH is consistently increasing, especially in regards to the multiple liquidity pools supporting ankrETH and Ankr’s other liquid staking tokens. Therefore, if you’re looking for maximum capital efficiency with your ETH, ankrETH is the way to go. Not only do you maintain liquidity of your staked tokens but you can use those staked tokens in multiple different ways to increase your yield in the DeFi market.

On top of that, ankrETH will soon bring other benefits like flash unstaking, which will allow for instant liquidity when needed. This capability is particularly advantageous in volatile market conditions or when taking advantage of time-sensitive opportunities.

Moreover, Ankr's focus on becoming the most liquid liquid staking in the market further amplifies the benefits for users. By enabling the seamless transfer and staking of ankrETH and other liquid staked derivatives between chains, Ankr maximizes capital efficiency while reducing the barriers associated with cross-chain transactions. Ankr’s liquid staking solutions provide maximum liquidity of your assets.

Conclusion

Ankr's omnichain liquid staking efforts have propelled the DeFi industry forward, providing users with unparalleled flexibility and earning potential. With ankrETH leading the charge on Ethereum and plans to expand to other chains, Ankr continues to revolutionize the staking landscape. By prioritizing omnichain solutions like bridging and maximizing token utility we ensure that you can maximize their capital efficiency and make the most of their staked assets.

Similar articles.

Application-Specific Blockchains: More Flexibility & Scalability for Web3 Development

Blockchains for Application: Greater Flexibility and Scalability for Web3 Development

Introduction

All inventive scaling methods have emerged in the continuous attempt to make blockchains sufficiently...

Part 1: Guide To Launching Your Own Blockchain With AppChains

Kevin Dwyer

March 7, 2023

Ankr AppChains allows any Web3 application or project team to create their own dedicated blockchain as a sidechain in ecosystems like Polygon, BNB Application Sidechains,...

ZetaChain: Ankr's Newest RPC Connection

Kevin Dwyer

April 3, 2023

Start building on the only public blockchain connecting all others with Ankr’s RPC connection and gateway to communicate with ZetaChain.

Ankr is thrilled to...