ANKR: The Token Powering Multichain Infrastructure

Kevin Dwyer

February 2, 2023

7 min read

With tens of thousands of holders around the world, the ANKR token has frequently been found in the top 100 in terms of market cap. This is because many have seen and understood the strong utility behind the token and why it’s important to the infrastructure and operations of web3. ANKR is primarily used to facilitate a connection between blockchain data and the decentralized apps and developers that need access to it. We can examine the fundamentals of the ANKR token and see if its key indicators paint a positive picture of its utility and room for growth as a way to connect with all blockchains supported by Ankr.

Let this article be your guide to the ANKR token with important data points to consider, key milestones, and our roadmap for expanding token utility.

What Contributes To ANKR Token Use?

The Web3 industry has learned that you can’t just launch a token and expect it to grow without significant utility. Tokens need to play a critical role within applications and ecosystems to provide true importance for holders, among other factors that we’ll get into below.

Without a degree in economics required, we can take a look at some simple indicators of strong digital assets, and how ANKR fairs in all of them:

- Scarcity: The ANKR token has a max supply of 10 billion. Having a fixed supply of ANKR is definitely good for one of the key indicators of healthy assets, which is rarity. In 2022, Ankr also released two features that will decrease the availability of ANKR – payment in ANKR for services, and ANKR staking. These two items will effectively “lock up” an ever greater amount of ANKR in our marketplace for infrastructure (discussed below). We have already seen some notice the supply of ANKR on DEXs has been shrinking as more developers are buying it to pay for their infrastructure use. This is a healthy sign that demand for ANKR is growing alongside the portion that is being utilized within Ankr Network while the supply remains the same.

- Utility: ANKR powers a decentralized infrastructure marketplace responsible for serving billions of daily requests to dozens of supported blockchains. Developers pay ANKR for making requests to full nodes, node providers are paid in ANKR for their services, and stakers help secure the system by contributing to the collateral tied to each full node in return for a share in the rewards. This has all been implemented in just the last year, and Ankr hasn’t even finished the utility roadmap (read more on this below).

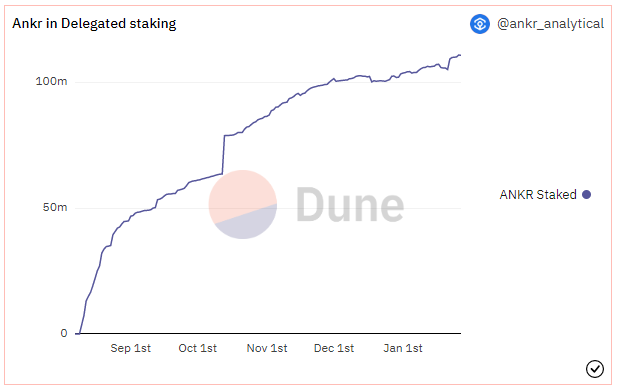

- Incentive Structure: Since Ankr released ANKR token staking in August 2022, it has provided a new incentive for holding the token to receive a current APR of close to 10%. Holders can now earn a significant APR for staking their ANKR while improving the security and trustworthiness of the full nodes running as a part of the Ankr Network. In just a few months, the TVL for the ANKR token has jumped to $3,036,179 (as of 1/27/2023). As this amount of locked ANKR increases, the amount of available ANKR again decreases, improving scarcity and providing a new incentive to hold ANKR.

What Exactly Does the ANKR Token Do?

ANKR is an ERC-20 token that Web3 developers use as payment for accessing Ankr’s global network of full (RPC) nodes running on dozens of different blockchains. In order to build and operate decentralized applications, developers need to establish connections to the blockchains their apps interact with. This allows them to pull any data from the nodes that their applications will need to complete tasks like populating wallet balances, verifying ownership, or executing transactions. Decentralized apps and wallets can’t operate without a connection to blockchains – ANKR ensures there is plenty of incentive for node providers to offer them.

The ANKR token is very similar in utility to tokens like LINK from Chainlink, or GRT from the Graph Protocol. These tokens also enable what we call the “infrastructure” of Web3. They create an incentive to provide the computing power it takes to store or retrieve data from nodes so it can be delivered to the applications that need it.

Just like making on-chain transactions, retrieving data from full nodes comes at a computational cost. Think about when you initiate a crypto transaction using MetaMask or any dApp – you need to pay a “gas fee” in ETH because it provides an incentive for validator node operators to provide their service that takes computational power and their labor. However, most Web3 users don’t realize that there is another gas fee being paid for data retrieval from blockchain full nodes, except this fee is paid for on the end of the Web3 project or app paying full or “RPC” node providers (unless they run their own nodes).

TL;DR – ANKR is:

- A gas token for devs to pay for multichain infrastructure (full node use)

- A crypto-native form of payment for Ankr’s products and services

- An operational necessity for decentralized Web3 infrastructure

What Is ANKR Primarily Used For?

The more activity, transactions, and blockchain requests are being made across Web3, the more useful the ANKR token becomes. For example, one of our supported chains with the most requests made to it every month is Polygon. As Polygon welcomes more applications building on it, many of them will choose Ankr as their connection to Polygon full nodes using the ANKR token as payment (thereby increasing demand). But this same idea doesn’t just apply to Polygon – it applies to every blockchain Ankr supports, including the Binance Smart Chain, Ethereum, Polkadot, Solana, and many, many more.

There are several reasons someone would need to hold ANKR as a part of our decentralized infrastructure marketplace, let’s take a look at a few below.

Paying for blockchain connections for your dApp

ANKR gives users access to full nodes on the Ankr Network. With a flexible and affordable pay-as-you-go model, users spend ANKR to make requests to the different blockchains they need to communicate with. Using crypto as payment for Web3 services is more convenient for many projects and developers who can swap their tokens for ANKR using a DEX, CEX, or wallet.

Staking ANKR to support Web3 infrastructure and earn a yield

ANKR token staking is similar to the idea of staking to help secure PoS networks. However, instead of delegating ANKR to validator nodes, ANKR token staking introduces the ability for anyone to stake to full nodes running on dozens of different chains for the first time ever. By doing so, you can earn a substantial APR of around 10% currently, with the ability to unstake your tokens whenever you wish.

Providing ANKR token collateral to become a node provider (soon)

As an increasing number of dApps, NFT projects, games, companies, metaverses, and other parties use Ankr, it is important that they reach the most decentralized node infrastructure possible. To accomplish this, Ankr is welcoming many more independent node providers to serve blockchain requests coming to the Network in 2023. To become a node provider on Ankr Network, you must deposit a large number of ANKR tokens as collateral to help ensure honest and optimal network participation. Once you’ve made your deposit and started providing your node(s), you’ll earn rewards for serving traffic in the form of ANKR tokens, completing the last part of the circular economy and marketplace that is Ankr Network.

Our Roadmap To Strengthen ANKR Token Utility

In the Ankr 2.0 whitepaper released in July 2022, we introduced the vision for Ankr Network as a decentralized system where independent node operators work alongside Ankr nodes to power the growth and development of Web3, with a subsidy from the additional services and features provided to developers by Ankr ecosystem contributors and partners.

What’s happened since July 2022? We have already implemented the first steps for making this vision a reality with the introduction of ANKR as a payment method for blockchain requests and a new market mechanism (staking) that brought developers, node providers, and Ankr ecosystem supporters together to solidify our decentralized node marketplace. After all, to build a truly decentralized Web3 protocol, “tokens must be more valuable to network participants than they are to purely financial holders.”

We’ve already implemented two out of three items on our roadmap:

✅ ANKR Token used as payment for infrastructure services.

✅ Enable staking to full nodes for the first time with ANKR Staking.

🛠️ (In progress) Onboard an increased number of independent node providers to serve blockchain requests.

Once all elements of the roadmap are in place, the ANKR token’s utility will be dramatically improved, offering a fully functional marketplace for Web3 infrastructure.

Final Thoughts

ANKR shows strength in key areas that paint a positive picture of utility, and the Ankr team has intentionally aligned the ANKR token to grow as much as possible with the Web3 industry as a whole. What is coming for the market in the next year is unknown, but the team is as optimistic as ever that the world will adopt Web3 benefits as they are seamlessly integrated into our everyday lives.

Join the Conversation on Ankr’s Channels

Twitter | Telegram Announcements | Telegram English Chat | Help Desk | Discord | YouTube | Reddit | LinkedIn | Instagram