How Ankr Powers RPCfi: Turning Infrastructure into Yield

October 28, 2025

5 min read

The future of Web3 depends on more than speed and scalability; it depends on how value circulates across the stack. Every transaction, API call, and data request consumes infrastructure, yet the revenue from that usage has traditionally leaked out of the blockchain economy. Ankr and Neura are changing that with a new model called RPCfi, where infrastructure becomes a self-sustaining source of liquidity and growth.

Ankr, the world’s most widely used Web3 infrastructure provider, processes over 1 trillion RPC requests per month across more than 85 blockchains. By integrating directly with Neura, a new EVM-compatible Layer 1 chain purpose-built for stablecoins and real-time finance, Ankr is pioneering a model that routes RPC spending back onchain as liquidity, yield, and sustainable rewards.

This partnership closes the loop between usage and value, turning data access into an economic engine for every app, chain, and ecosystem plugged into Ankr.

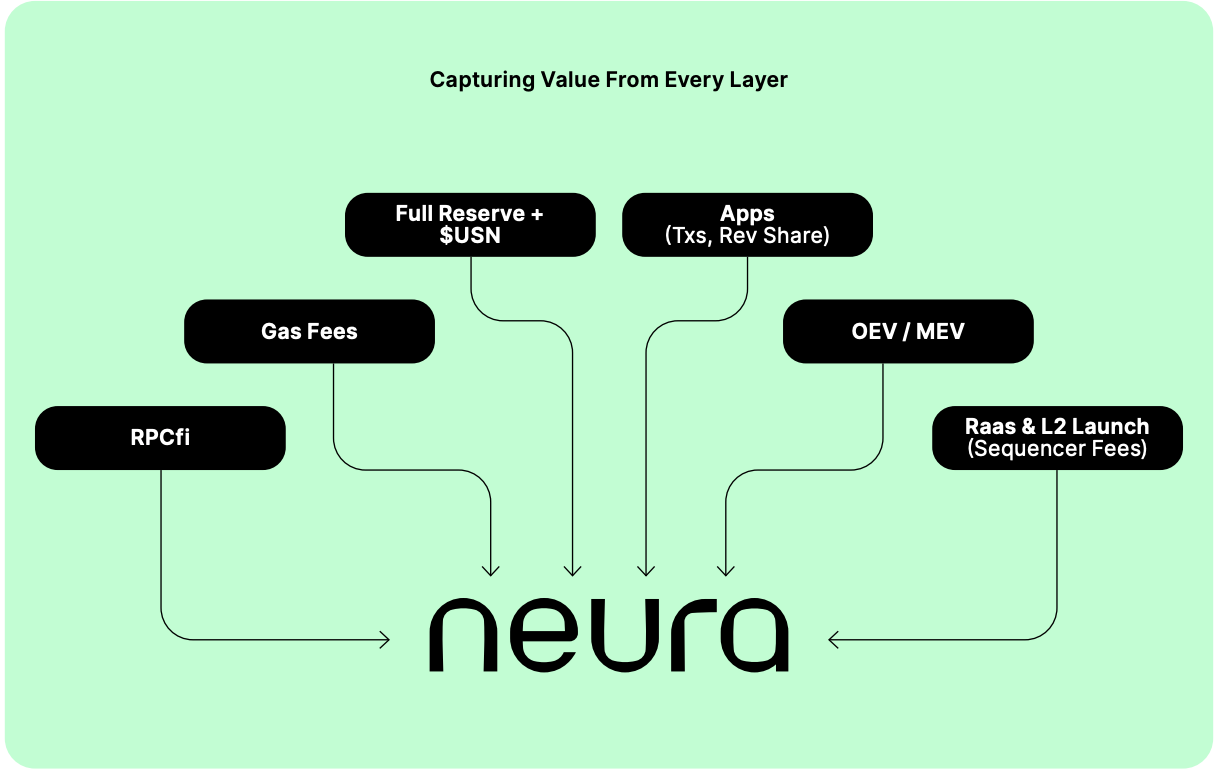

Capturing Value From Every Layer

In traditional setups, node operators and app developers pay for RPC services in fiat. Those costs vanish offchain, benefiting no one except the infrastructure vendor. RPCfi changes this equation.

With Ankr powering RPCfi for Neura, every RPC call (whether it comes from a DeFi app, an L2 rollup, or an analytics service) becomes a catalyst for onchain liquidity. The model ties into other sources of real yield, amplifying the power of Neura’s ability to capture and recycle real value:

Together, these components form a system that channels infrastructure usage directly into the chain’s liquidity backbone. Instead of value leaking away to external service providers, it circulates within the network, compounding with every user interaction.

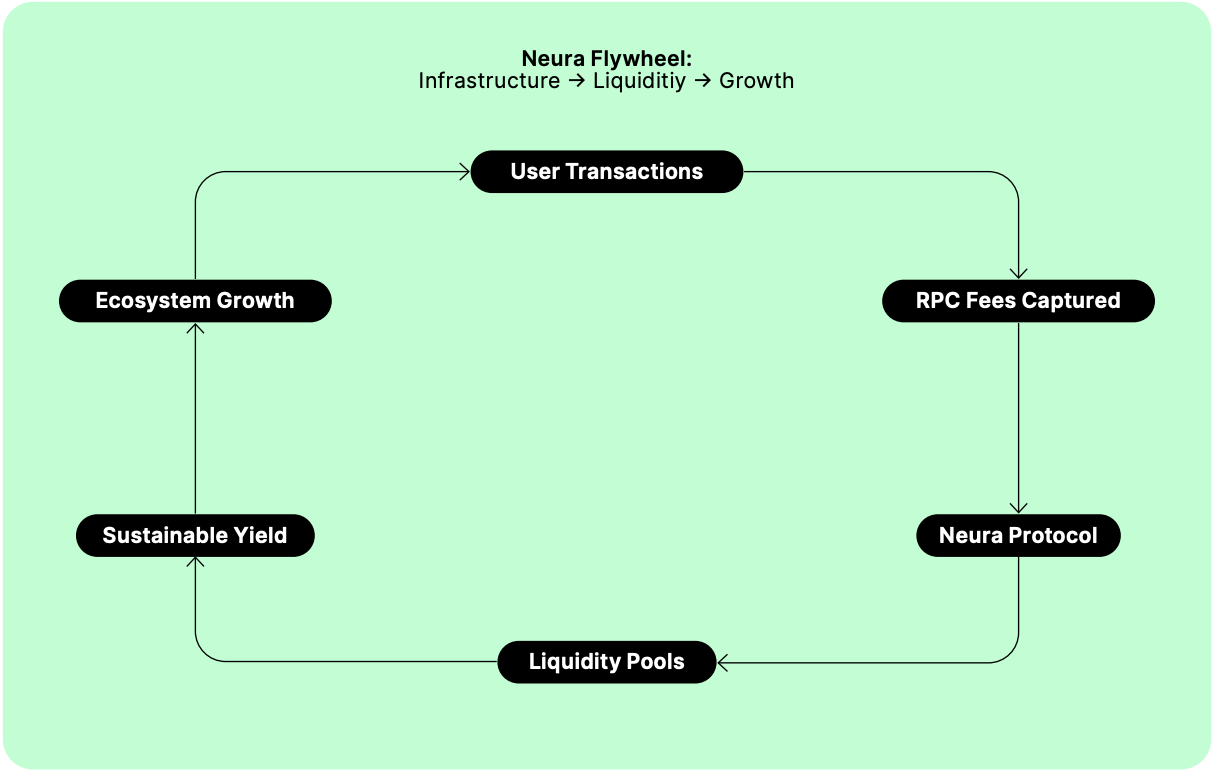

The Neura Flywheel: Infrastructure → Liquidity → Growth

Neura’s flywheel, powered by Ankr’s infrastructure, embodies a new economic feedback loop:

- User Transactions: Every dApp, wallet, or protocol query initiates RPC calls served by Ankr’s global node network.

- RPC Fees Captured: A portion of the revenue from these requests is collected via the RPCfi mechanism.

- Neura Protocol Integration: That value is bridged onto Neura, where it becomes protocol-level liquidity.

- Liquidity Pools: Funds are deposited into pools, creating sustainable yield for participating dApps.

- Sustainable Yield: Apps earn yield based on their actual network activity, not token emissions.

- Ecosystem Growth: As yields grow with real usage, more developers and projects build on Neura, expanding transaction volume.

- Cycle Reinforcement: The loop restarts, compounding ecosystem liquidity with every call served by Ankr.

This self-reinforcing design is what makes RPCfi revolutionary. It creates a usage-indexed yield system (yield that scales with demand, not with speculative emissions).

Turning Calls Into Capital: How It Works in Practice

Here’s how RPCfi works in practice:

- A decentralized application (DApp) spends $10,000 per month on Ankr’s Premium RPC services on BNB Chain.

- Under the new RPCfi model, 50% of that spend ($5,000) is automatically captured and redirected onchain.

- The first step in this is bridging the USD value to the Neura blockchain.

- That $5,000 is then used to buy equal portions of BNB and ANKR ($2,500 each).

- The resulting assets are then deposited into a liquidity pool via Zotto, Neura’s flagship veDEX/AMM.

- The rewards generated by that liquidity position, including emissions and RPCfi points, go directly back to the originating DApp.

- The DApp can then choose how to use those rewards: distribute them to holders, reward stakers, or reinvest them.

Instead of treating infrastructure as a cost center, projects can now treat it as a recurring liquidity strategy. Every query, every transaction, and every RPC request becomes an investment into their own ecosystem’s health.

Why Ankr Is the Only Provider That Can Make This Work

Ankr isn’t a run-of-the-mill B2B nodes as a service. It’s a Web3-native infrastructure layer designed to circulate value back into crypto ecosystems.

- Massive Scale: With over 1 trillion RPC requests per month, Ankr’s reach across the blockchain universe provides unparalleled liquidity potential. If all of those calls participated in RPCfi, the industry would see a huge amount of recurring onchain yield redirected toward builders, apps, and protocols.

- Private Global Fiber Network: Unlike infrastructure relying on AWS or centralized cloud providers, Ankr operates a global bare-metal and fiber backbone purpose-built for blockchain workloads. This ensures resilience, privacy, and decentralization, safeguarding the ecosystem from the outages and chokepoints that plague centralized Web2 systems.

- Web3-Native Billing: Ankr’s model supports onchain payment flows and transparent integration with RPCfi, letting developers convert their infrastructure costs into protocol-level liquidity instantly.

No other RPC provider combines scale, performance, and native DeFi integration like Ankr does. This makes it the inevitable default for any ecosystem seeking to capture full-stack value from data access to liquidity provision.

Why It Matters for Developers and Chains

For developers, RPCfi means that every line of code making an RPC call now supports your project’s growth. The more your users interact, the deeper your liquidity pool becomes.

For blockchains, it represents a new way to bootstrap liquidity and user retention without relying on emissions or token subsidies. Network usage directly translates into capital efficiency and yield.

And for users, it signals a shift toward real, sustainable DeFi where value creation comes from genuine activity, not speculation.

The New Era of Infrastructure-Backed Yield

The old model of growth through incentives is dying. The new model grows through usage, liquidity, and compounding infrastructure value. With Ankr and Neura’s RPCfi, the essential infrastructure of Web3 and the invisible backbone that powers every wallet, DEX, and L2 finally becomes an engine for sustainable yield.

Ankr’s integration with Neura doesn’t just introduce a new revenue model; it redefines how the blockchain industry funds itself. Every call strengthens the network. Every transaction deepens liquidity. Every ecosystem connected through Ankr becomes part of a self-sustaining Web3 economy.

Web3 deserves better. And with Ankr, it’s finally here.

Join the Conversation on Our Channels!

X | Telegram | Substack | Discord | YouTube | LinkedIn | Reddit | All Links