Stablecoin Breakout: The $27T Tectonic Shift in Money, Payments, and Power

May 12, 2025

6 min read

Last year, stablecoin transaction volume reached $27.6 trillion, blasting past the volumes of Visa and Mastercard put together by 7.7%.

With global transaction volumes now rivaling traditional payment networks, and major issuers on track to surpass sovereign nations in U.S. Treasury holdings, a monetary transformation is underway. Citibank recently called stablecoins the potential catalyst for blockchain's "ChatGPT moment" in 2025. And if Citi's right, we're headed for a potential $3.7 trillion stablecoin market cap by 2030 in their bull case.

It is becoming increasingly clear that we're not witnessing a fintech trend; we’re watching the birth of blockchain’s real electronic cash system that will change financial markets forever.

Slowly, Then All At Once

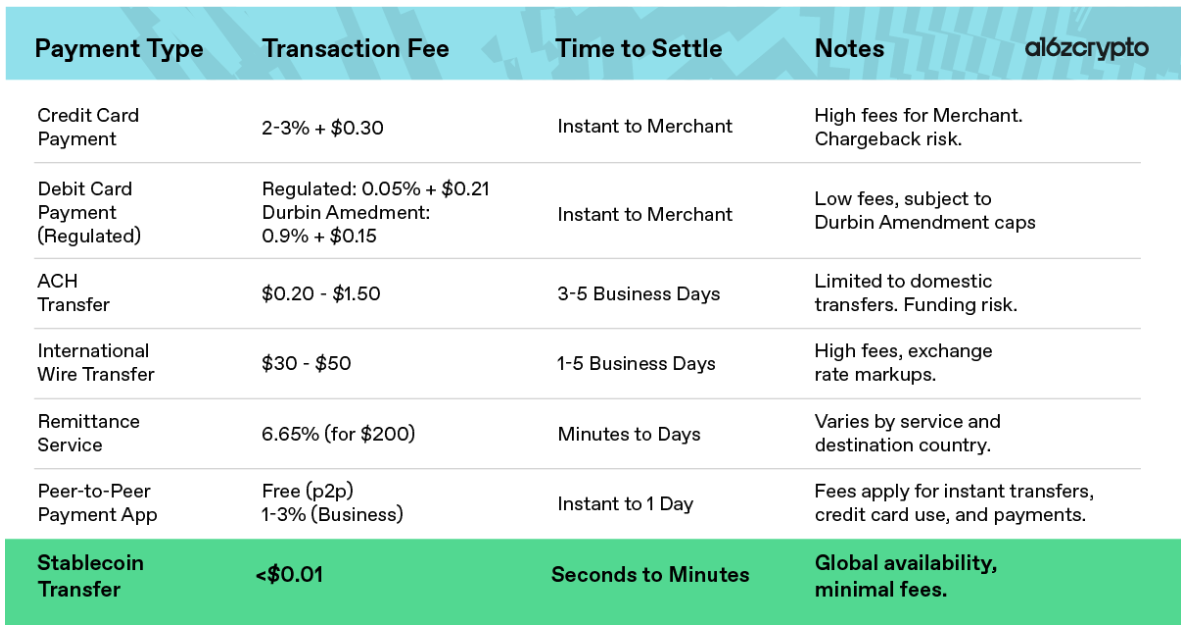

The meteoric growth of the past year is driven by stablecoins' utility and efficiency in use cases like cross-border transactions, offering faster settlement times and lower fees compared to traditional banking systems.

Major financial institutions and fintech companies are embracing stablecoins, as seen in headlines of just the past month, like:

- Visa and Bridge Partner to Make Stablecoins Accessible for Everyday Purchases

- Stripe Brings Stablecoin Accounts to More Than 100 Countries

- Meta Is Looking to Enter Red-Hot Stablecoin Market

- Coinbase Waives Fees on PayPal’s Stablecoin In Crypto Payments Push

- Mastercard Unveils End-to-End Stablecoin Capabilities, Will Launch Card With OKX

Why Stablecoins Are Exploding Now: We Had To Show, Not Tell

Source: a16zcrypto – How stablecoins will eat payments, and what happens next

Comedian John Oliver once said of Bitcoin (which can be expanded to crypto) that it encompasses “Everything you don’t understand about money combined with everything you don’t understand about computers.” This is true for the majority of people.

Crypto confused the world when it went mainstream, stablecoins included. It took a while to prove their worth by showcasing them in action rather than waffling about the intricacies of blockchain. But as soon as one platform adopted stablecoin transfers and saw the benefits pictured above, it opened the floodgates, especially now that governments and financial institutions have had plenty of time to do their due diligence.

Stablecoins in 2025 are no longer just crypto-native settlement tools, they’re becoming the connective tissue of a global, programmable money infrastructure. Three major drivers explain this explosion:

- Institutional Adoption and Payment Integration: The past year saw a tidal wave of corporate involvement. Mastercard and Visa both launched support for stablecoin clearing and merchant settlements. Stripe, PayPal, and Shopify now allow stablecoin payments in over 100 countries. These developments are no longer experiments, they’re infrastructure moves.

- Real-World Asset Tokenization and Treasury Demand: With stablecoins increasingly backed by short-term U.S. Treasuries, issuers like Circle and Tether are becoming among the largest single holders of sovereign debt. This shift provides a digital-native yield product and feeds into tokenized finance, where stablecoins are the gateway for accessing real-world assets on-chain.

- DeFi and Cross-Border Remittances: Stablecoins are transforming DeFi into something institutionally palatable, with transparent, interest-bearing pools backed by real collateral. At the same time, remittance-heavy economies, from the Philippines to Nigeria, are embracing dollar-backed digital cash for fast, low-cost transfers.

Global Regulatory Landscape: Toward Clarity, Slowly but Surely

Across the world, governments have moved from cautious observation to active regulation. The European Union’s Markets in Crypto-Assets (MiCA) framework came into force in 2024, setting the gold standard for stablecoin governance. Under MiCA, issuers of stablecoins, particularly e-money tokens, must adhere to strict capital, liquidity, and transparency requirements, paving the way for EU-wide adoption and institutional entry. Similarly, the U.K. has integrated stablecoins into its Financial Services and Markets Act, enabling FCA oversight and recognizing stablecoins as a means of payment.

In Asia, Japan’s 2023 law requiring full fiat reserves and bank-licensed issuance has fostered a compliant, bank-integrated stablecoin market. Singapore’s Monetary Authority (MAS) also leads with clear guidelines, supporting innovation while safeguarding financial stability. Meanwhile, Hong Kong has become a hub for regulated experimentation, welcoming both centralized and algorithmic stablecoin pilots.

The U.S., in contrast, continues to lag behind. While the GENIUS Act failed in Congress in May 2025, pressure from industry and global peers has prompted regulatory improvisation: the SEC and CFTC are asserting overlapping authority, and the Federal Reserve has signaled that non-bank stablecoin issuers may soon require access to Fed-level oversight. Despite fragmentation, progress is accelerating, with bipartisan bills resurfacing in 2025 that could finally bring national clarity. The IMF and BIS continue to call for interoperable global standards to prevent regulatory arbitrage and financial fragmentation.

Top 3 Stablecoins by Market Cap in 2025

1. USDT (Tether) – $149B

Tether continues to dominate the stablecoin market, particularly in offshore and emerging markets. Despite persistent concerns over transparency and reserve audits, its deep liquidity, exchange integrations, and first-mover advantage have made USDT the default trading pair across most of the crypto world. Its exposure to U.S. Treasuries has also made Tether one of the largest holders of short-term U.S. debt, blurring the line between digital assets and sovereign finance.

2. USDC (Circle) – $60B

Circle’s USDC has cemented itself as one of the most institutionally trusted stablecoins. Backed by regulated financial partners and managed through full-reserve, audited holdings (often with BlackRock’s involvement) USDC is the go-to choice for fintech platforms, tokenized assets, and real-world financial integrations. Its role as the bridge between traditional finance and DeFi has only grown with its presence on major L2s and global payment platforms.

3. USDS (Sky) – $7B

USDS is the upgraded and rebranded version of DAI, designed to power the open Sky ecosystem (the new version of MakerDAO) and offer new crypto rewards and experiences. USDS is the surprise entrant into the top three, rapidly gaining traction through its foundation on the decentralized Sky Protocol.

The Future of Stablecoins: Global Money Without Borders

Looking forward, stablecoins are on the brink of becoming a new layer of internet-native money. With scaling solutions drastically reducing fees and zero-knowledge proofs enabling compliant privacy, stablecoins are poised to dominate everything from cross-border payroll to e-commerce to AI agent transactions. We’re also seeing governments and CBDCs indirectly validate the model: while central banks still hesitate to issue retail CBDCs, they are increasingly open to regulated private stablecoins operating under clear rules.

Ankr: The Infrastructure Beneath It All

As stablecoins become the lifeblood of global digital commerce, the need for high-performance, reliable blockchain infrastructure is more critical than ever. That’s where Ankr comes in. With its robust support for RPC services, blockchain creation services, and staking services, Ankr is quietly enabling the very rails that make stablecoin transactions possible at scale. Whether it’s facilitating secure payments, deploying AI-powered smart contracts, or integrating real-world assets, builders need infrastructure that won’t buckle under global demand.

Join the Conversation on Our Channels!

Twitter | Telegram | Substack | Discord | YouTube | LinkedIn | Reddit | All Links