Parachain Liquid Crowdloan market makers

Traditional finance & fair value estimation

In traditional finance, bond trading is enabled by market makers who provide liquidity to the market. Banks and Brokers usually operate as market makers, estimating the fair value of a specific bond, which depends on several factors such as credit risk, sensitivity to changes in interest rates (duration risk) and liquidity risk (some bonds are more liquid than others). Duration risk is also positively correlated to the maturity of the bonds.

Parachain Liquid Crowdloan & fair value estimation

For Parachain Liquid Crowdloan, fair value estimation depends on factors different from traditional finance. However, the spirit of Fair Value estimation is similar.

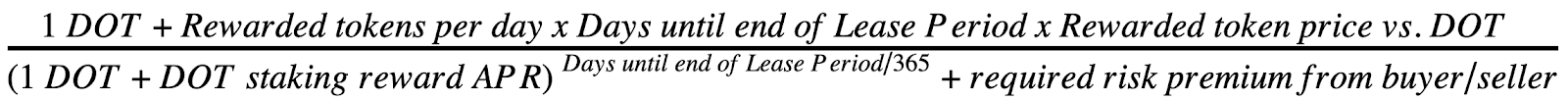

Here is how we ascertain price of 1 Parachain Liquid Bonding token:

Some of the elements of the formula depend on the user's personal risk tolerance, such as the required risk premium. Other factors could also be considered if a user is willing, for example the perceived risk associated with Ankr.

Market makers

The need for market makers arises due to the complexity of estimating the fair value of a product. For example the need to make informed decisions and assumptions.

Due to the risk of not estimating a product perfectly, market makers are compensated through the bid/ask price. This is the difference between the buy and sell price. The mid-price (median between buy and sell price) ultimately defines the expected value of a Parachain Liquid Crowdloan tokens. Since there are likely to be several Parachain Liquid Crowdloan tokens for every project winning Parachain Slot auctions, Parachain Liquid Crowdloan tokens are likely to have different prices depending on the price of the rewarded tokens they embed.

Projects winning Parachain Slot auction are aiming to reward DOT lenders from Parachain crowdloans with a higher APY than Polkadot staking rewards in order to compensate users for the lower liquidity of bonded DOT in Parachain slot auction (lease period maximum 24 months) when compared to 28 days unbonding period for Polkadot staking. As a result, Polkadot Parachain Liquid Crowdloan tokens are expected to generate more rewards than KSM/DOT staking, and if the token from the projects increases in price more than DOT token price, the APY of the Polkadot Parachain Liquid Crowdloan is expected to become higher, unless the Polkadot Parachain Liquid Crowdloans price increases itself. As such, the price of Parachain Liquid Crowdloan tokens depends strongly on the price of the project’s token vs DOT token.