Ankr DeFi

What is Ankr DeFi?

Ankr DeFi Trade is a Liquid Staking data aggregation tool providing access to real-time trading prices.

It allows users to find all liquidity staking DeFi integrations to trade between Liquid Staking tokens and other assets.

Liquid Staking tokens, for example, ankrETH, are tokens users get when staking their assets, ETH in this example, on Ankr Staking.

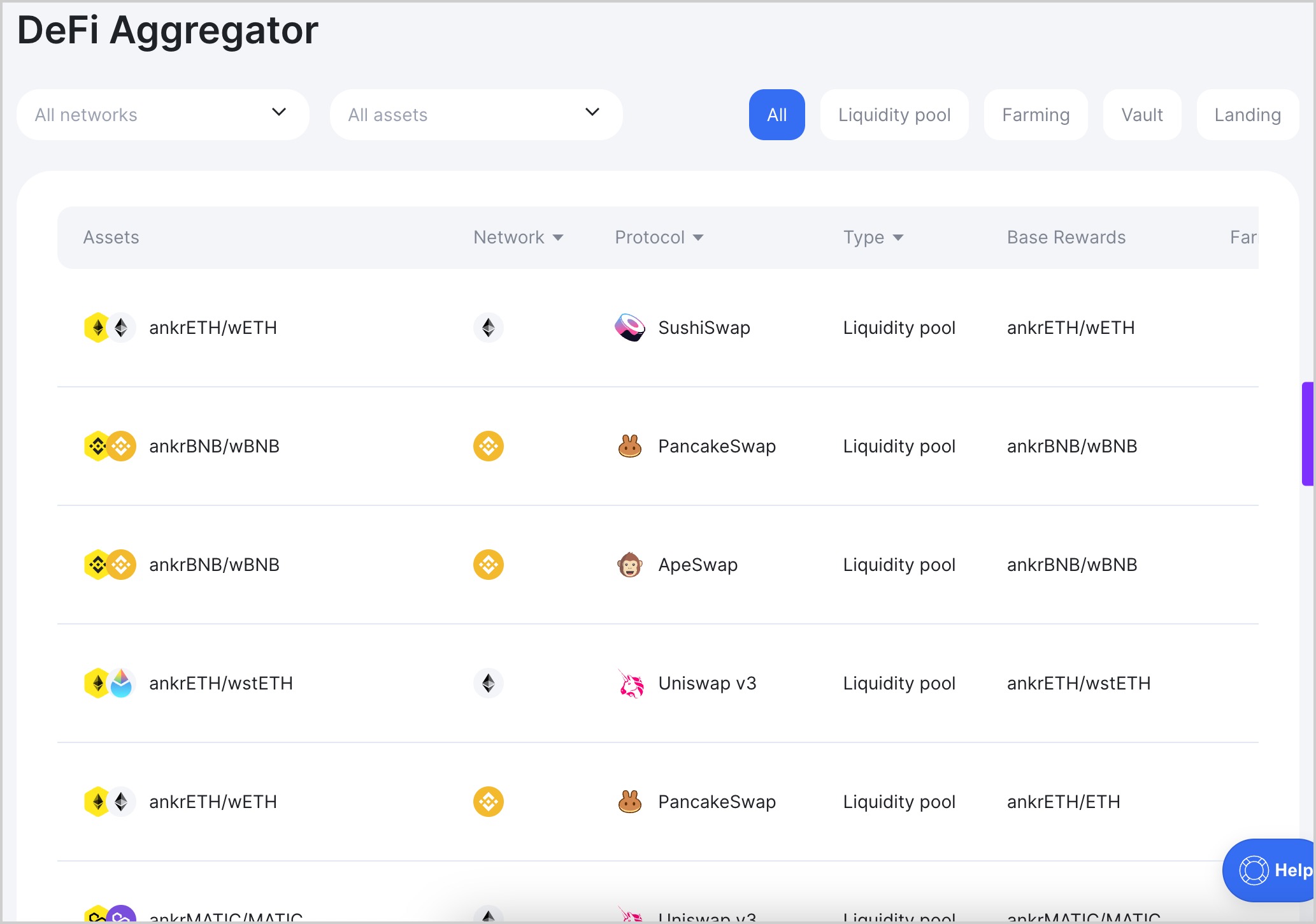

Ankr DeFi Dashboard

For easier access, Ankr DeFi features a cross-chain dashboard where users can choose Liquid Staking tokens and assets to trade, and platforms to trade on.

Currently, the dashboard features:

The Borrowing and Indexes functionality is coming later.