Ankr Parachain Liquid Crowdloan

What are Kusama and Polkadot Parachain Liquid Crowdloan?

Kusama and Polkadot Parachain slot auctions are among the most widely discussed and anticipated events in the blockchain space. They provide the winning projects with access to innovative multi-chain infrastructure while offering an opportunity for regular audiences to be involved in the vibrant Polkadot ecosystem. Through crowdloan campaigns, anyone can contribute KSM and DOT to support the bids of their favorite projects, and receive their tokens as a reward.

However, these rewards have their limitations. Once a winning project secures a Parachain slot, crowdloan participants find their tokens locked up for up to two years with Polkadot, and 48 weeks with Kusama.

To tackle this issue, Ankr introduces Parachain Liquid Crowdloan – an innovative instrument that unlocks the liquidity of bonded DOT, collects rewards from winning Parachain slot auctions, and distributes token rewards from the winning project’s to Parachain Liquid Crowdloan token holders.

Rewards from winning slot auctions are expected to become higher than Polkadot and Kusama staking rewards, which incentivizes more Parachain Liquid Crowdloan token holders to contribute their DOT and KSM tokens and benefit from a higher ROI.

Why Parachain Liquid Crowdloan?

Like Liquid Staking, Parachain Liquid Crowdloan has other benefits beyond liquidity and solve a general problem specific to Proof-of-Stake, as well as Parachain slot auctions: capital inefficiency

By solving the capital inefficiency of Parachain slot auctions with Parachain Liquid Crowdloan, Parachain Liquid Crowdloan token holders benefit from:

-

Liquidity: Parachain Liquid Crowdloan enables liquidity on bonded DOT through an upcoming auction marketplace on Bounce Finance (opens in a new tab).

-

Higher Rewards: Ankr Staking collects rewards from projects winning Parachain Slot Auctions and enables Parachain Liquid Crowdloan token holders to claim rewards. To compensate contributors for the illiquidity risk of bonding KSM/DOT for up to 48 weeks/24 months, rewards are expected to be significantly higher than KSM/DOT staking.

-

Lending/Borrowing: OnX Finance (opens in a new tab) is developing a lending contract enabling it to collateralize Parachain Bonds and borrow DOT, which can be used to free up liquidity, or buy more Parachain Bonds on Bounce Finance (opens in a new tab).

-

Opportunity to become a DeFi Parachain Crowdloan Market Maker Estimate the fair value of Parachain Liquid Crowdloan tokens and buy below your fair value and sell above your fair value. The bid-ask spread (difference between your buy and sell price) will become your market marking revenue.

How Parachain Liquid Crowdloan works

-

Contribute DOT or KSM to your preferred project that is currently running a Polkadot or Kusama Parachain crowdloan to participate in the Parachain Slot auction.

-

DOT or KSM gets allocated to the project's crowdloan on Polkadot.js wallet making the user an indirect participant in the crowdloan (through Ankr Staking)

-

The project uses the crowdsourced DOT or KSM to participate in the Parachain Slot auction.

-

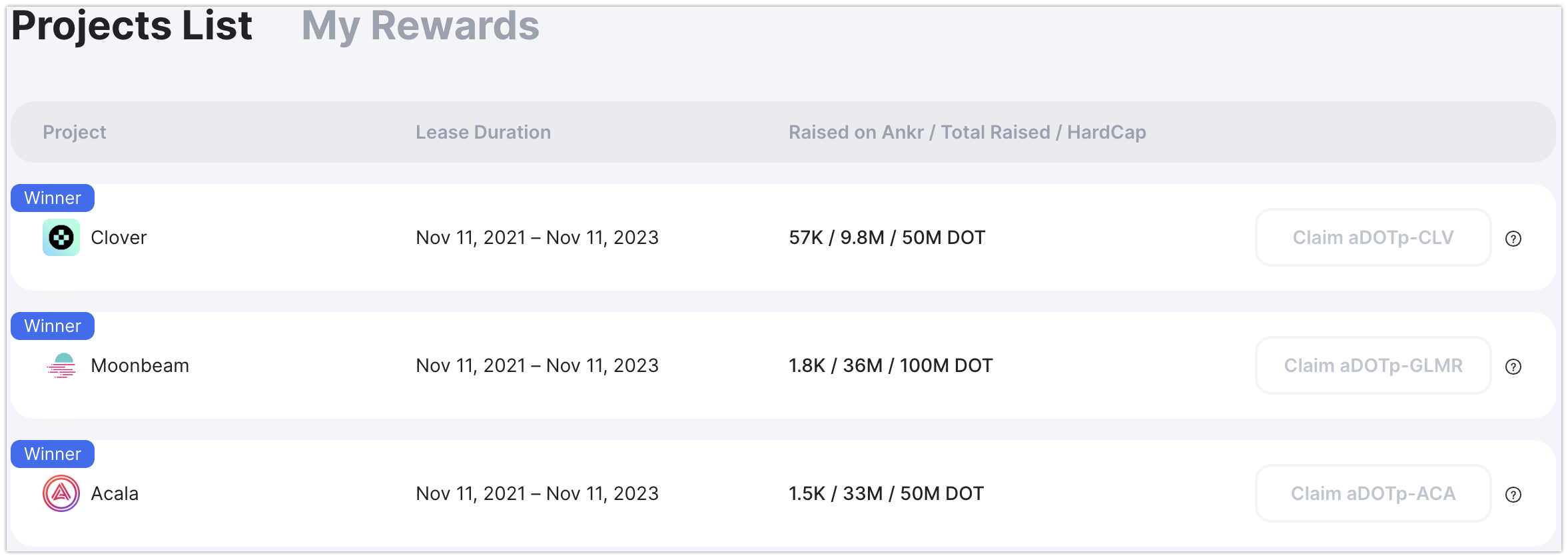

If a project you have contributed to wins a Parachain slot, you can claim a DOT or KSM Parachain Liquid Crowdloan from that project (aDOTp/aKSMp - Project Name). These are ERC-20 tokens for which rewards are claimable throughout the duration of the lease period. Rewards are calculated based on proof of time. Initially, only projects having existing ERC-20 tokens will be supported.

-

Ankr charges a 5% fee on distributed rewards. 2% goes to Ankr’s corporate treasury and 3% goes to Ankr’s buyback program.

-

For liquidity, Parachain Liquid Crowdloan token holders can sell on Bounce Finance (opens in a new tab) auction marketplace, or collateralize the Parachain Liquid Crowdloan and borrow DOT on ONX Finance (opens in a new tab).

GET STARTED

Parachain Liquid Crowdloan (opens in a new tab) is available now!